As students prepare for graduation, many are expecting an overwhelming amount of post-college debt. While student debt is an all-too-common problem, taking out loans is sometimes the only option.

Cathy Andreen, director of media relations, said the average student debt for The University of Alabama varies each year, but during 2011-12 it was around $10,000.

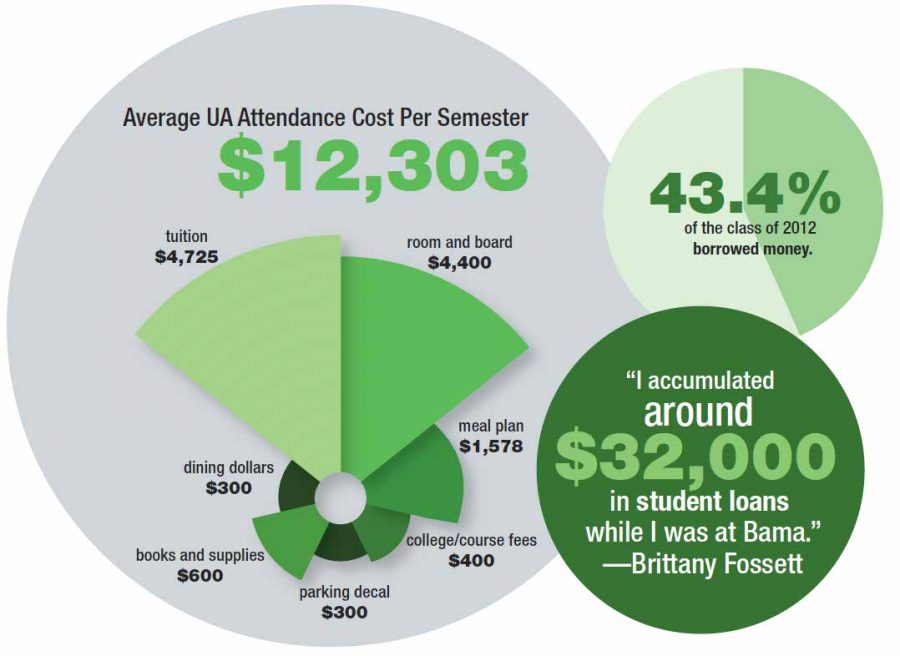

Andreen said the average “per-undergraduate-borrower cumulative principal borrowed” by 2012 undergraduate class graduates was $27,639, $22,403 of which was provided by federal loan programs. According to the Office of Institutional Research and Assessment, which posts financial data from past years, 43.4 percent of 2012 graduates borrowed money.

(See also “Government subsidizing of higher education worthwhile investment“)

Adam Zelensky, a junior majoring in nursing, transferred to the University in the fall of 2013. He spent his first two years at a community college taking advantage of cheaper tuition.

“Part of how I’m paying for school is a scholarship,” Zelensky said. “But it’s basically split between loans and the scholarship.”

As a full-time student, Zelensky is unemployed, but his leftover scholarship funds provide him with money for rent, gas and groceries. At the end of his undergraduate career, Zelensky will owe about $25,000.

Brittany Fossett, a May 2013 graduate, began repaying her student loans in December of 2013. After graduation, Fossett had more than $30,000 in debt.

“I knew before I started college that I would need to take out loans to pay for it,” Fossett said. “I was number one in my class and had a few scholarships, but not enough to cover everything.”

(See also “Seniors encouraged to begin saving for future“)

Fossett knew she wanted to attend The University of Alabama, and thus would have to take out loans. Like Zelensky, she did not hold a job as a student, so she lived frugally.

“I knew I wanted to come to Alabama,” Fosset said. “I could have gone to other schools with tuition paid for, but my dream was to come to Bama.”

Fossett works at NorthRidge Fitness and budgets part of her paycheck to pay back her loans.

“I accumulated around $32,000 in student loans while I was at Bama,” Fossett said. “I have a payment plan set up with the loan provider to pay $300 a month.”

The current average cost of attendance per semester at The University of Alabama is $12,303. That average comprises a plethora of factors: $4,725 for tuition, an average $400 in college/course fees, $300 in dining dollars, $1,578 for the required freshman unlimited meal plan, a maximum $4,400 for room and board, a $300 parking decal and various books and supplies at an average of $600.

The Division of Financial Affairs notes that while actual expenses can vary widely from student to student, the above semester budget is a reasonable estimate for the Fall 2013/Spring 2014 semesters.

Any financial aid questions can be answered at the financial aid office located at 106 Student Services Center. Office hours are Monday through Friday from 8 a.m. to 4:45 p.m.

(See also “Student finances focus of UA forum“)