Students who love spending can still find ways to save

October 14, 2020

College students at The University of Alabama and other universities find themselves wishing they knew more about their finances.

According to an article by CNBC, the average debt for a person between 18 and 24 is $22,000. Student loans and credit cards are the two major factors in accumulating debt.

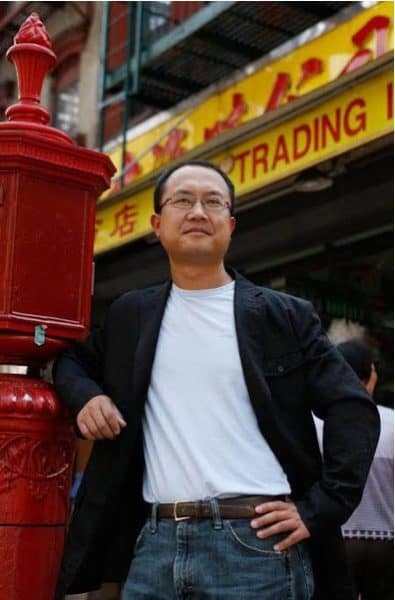

Parth Venkat, an assistant professor of finance at The University of Alabama, said he wishes that students learned more about personal finance while in high school.

“I had a personal finance class in high school, but most of what I’ve learned has come from my parents,” said Marie Tyree, a sophomore majoring in industrial engineering at the University of Wisconsin-Madison.

Tyree said she wished she knew more about the stock market and investing. For students who have never discussed finances with their parents, investing can be daunting.

Venkat said investing is good if a student has disposable income. People lose money in the stock market, so students have to know that before they choose to invest.

“In general, investing is going to be smarter than going to a casino and playing roulette,” he said.

Venkat mentioned that apps, such as Robinhood, are available for beginning investors. However, he emphasized that investing is not the most important thing to know about as a college student.

For college students who do not know much about money, Vankat said, there are two important steps to surviving college: understanding student loans and building credit.

Venkat said students should learn everything they can about their student loans, including what it is costing them, how long it might take them to pay it off and the rules for refinancing.

Venkat also said building credit is important for making large purchases. The earlier a student starts building credit, the more likely they will be to get a loan to purchase a car or house.

But Venkat added that certain methods of spending are not for everyone. Credit cards and debit cards can get some students into big trouble, either with debt or overdraft fees.

“Look at who you are,” he said, emphasizing that everyone spends differently.

Noah Jiter, a sophomore majoring in civil engineering at Bradley University, said he takes cash out of his savings account once or twice a month. Jiter is limited by the amount of cash he decides to take out per month.

“I’ve always used cash as spending money and have never kept a lot of money in my checking account,” Jiter said.

For someone who struggles with credit and debit card spending, this is one method to limit available money.

“The most important financial thing you can do is spend less,” Venkat said.

Venkat said he knows it is sometimes a struggle to save money because it is fun to spend money. He advised students to start a spreadsheet of what they owe. Venkat said working students could also set up an automatic deduction from their paycheck that goes into a savings account. This way, students do not even see their money before it goes into savings.

“Seeing all the credit card debt documentaries in high school just made me averse to them,” said Rick Zuehls, a junior majoring in nuclear engineering at Texas A&M University. Similar to Jiter, he also limits spending by using cash for many purchases.

While students have developed their own ways to save, they expressed that it would be beneficial for universities to also offer either a class or lectures about finances.

Nathaniel Lowe, a sophomore majoring in physics at The University of Alabama, said universities could help students better understand finances by offering a “one-credit class that is just about practical finances for the real world that could be really beneficial to people graduating college and starting their careers.”

Easten Wember, a sophomore majoring in computer science at Saint Norbert College, said she too feels that she lacks knowledge about finances.

She said it would be helpful “to have colleges offer…a seminar or something related to paying students loans or…budget[ing] money.”

For students having difficulties with finances, Venkat said Investor.gov is a great site for learning about financial planning and investing. He also said financial stress is a major driver of mental health issues.

“Do not underestimate mental health,” Venkat said.

He said even if a student does not want to see a therapist they should seek out professionals in the finance field who can offer them advice on getting out of debt and saving money.